Robin Brooks

@robin_j_brooks

Senior Fellow @BrookingsInst, previously Chief Economist @IIF and Chief FX Strategist @GoldmanSachs. Opinions are my own. Email: [email protected].

ID: 888118103095115780

20-07-2017 19:27:11

33,33K Tweet

339,339K Followers

223 Following

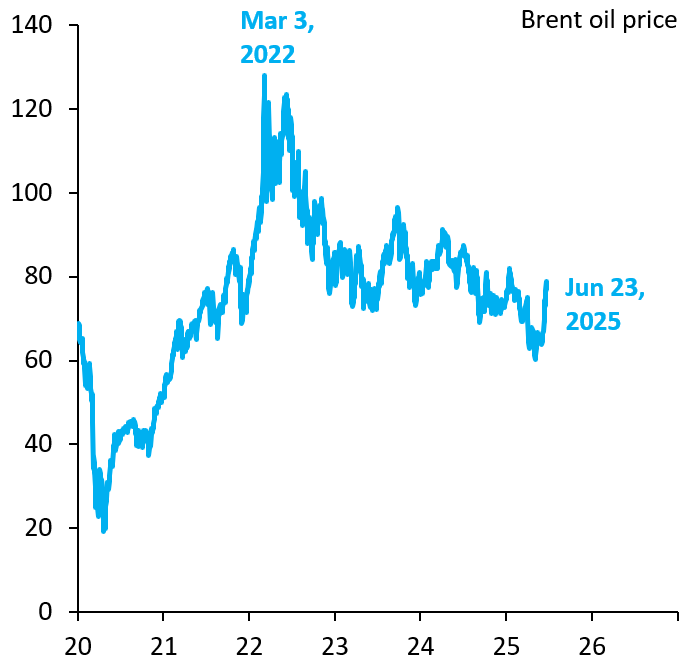

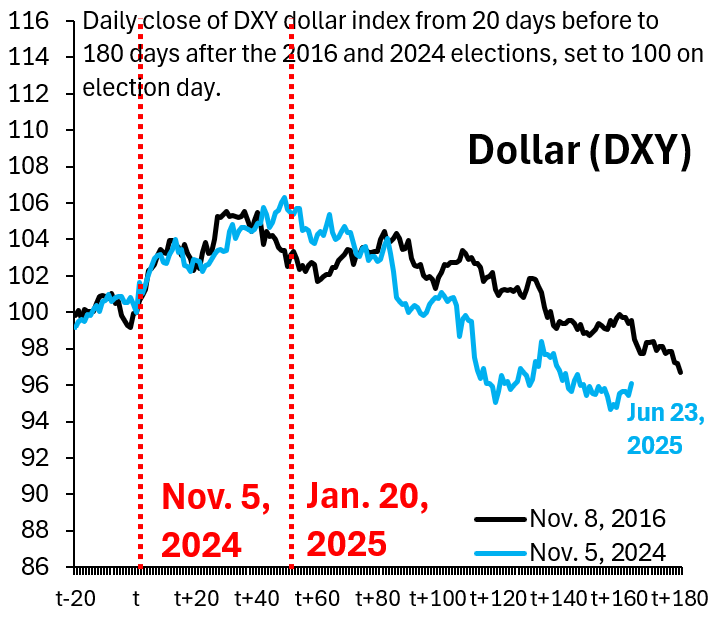

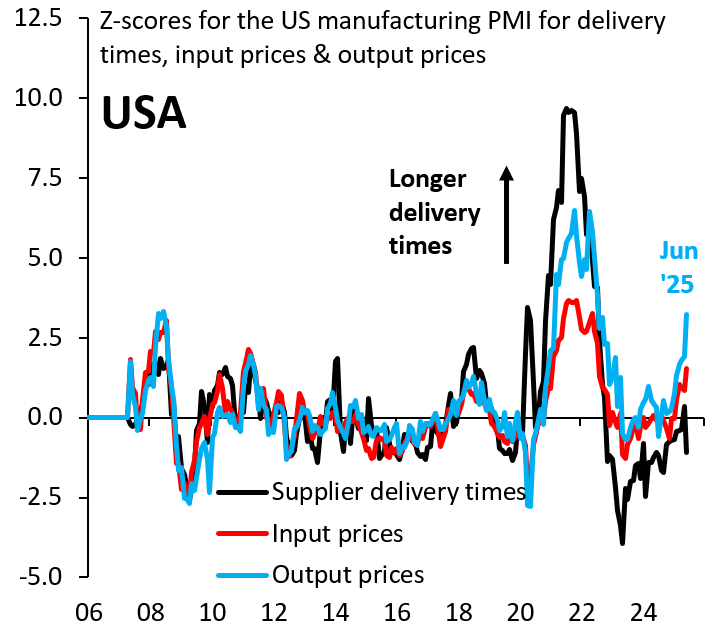

Very strong safe haven demand for $USD US is much more energy intensive than rest of G10 So rate differentials (blue) have fallen as risk of oil market disruption goes up But US$ (black) is up sharply These are pure, unadulterated safe haven inflows Robin Brooks #OOTT