Ryan Berckmans

@ryanberckmans

Ethereum community member and ETH investor

ID: 546460454

06-04-2012 02:51:02

12,12K Tweet

29,29K Followers

2,2K Following

NEW POD: The ETH Revival Santiago R Santos and I had Ryan Berckmans and Tom Dunleavy on Empire to discuss: 1) How to value ETH 2) Should L2 tokens exist 3) What went wrong 4) Tariff blockspace? 5) Pivot help/hurt L2s? 6) ETH’s next chapter ETH bulls rejoice.

Should Ethereum Tariff The L2s? Ryan Berckmans Tom Dunleavy Clip taken from our most recent episode out now! Links below! ↓

. Jeremy Allaire - jda.eth / jdallaire.sol you must not sell to Ripple, they will use the power it gives them over every DeFi protocol and every competitive blockchain for evil...if a definitive agreement is signed, we will be at the DoJ's and FTC's doorstep citing Ripple's history of campaigns against

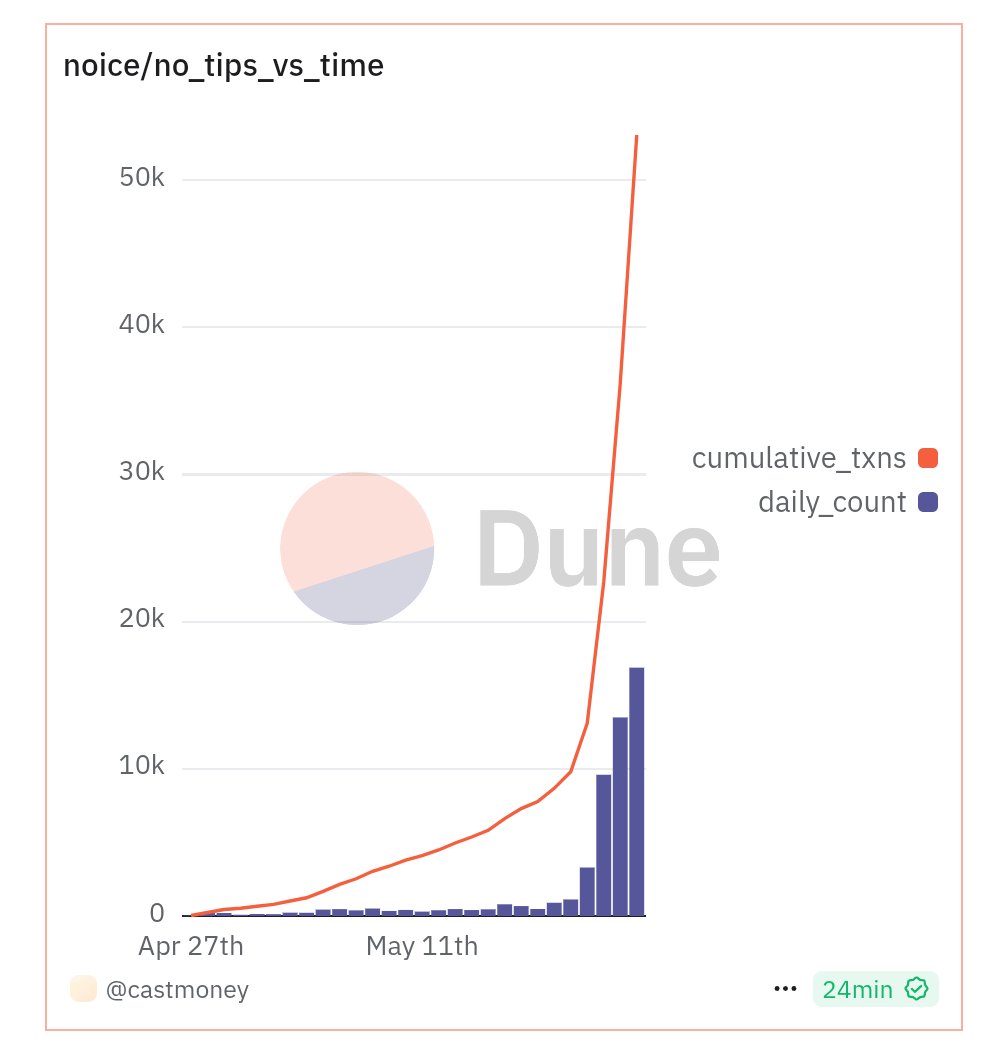

With mini app Noice (noiceapp.eth), any time you interact with somebody's post on farcaster (like or rt a post, etc), you automatically send them a tip in a token of your choice Noice is crushing it, with 10k+ daily payments over the past few days on Base L2 Noice is a pioneer