rysk finance && 🤌

@ryskfinance

Earn upfront on any asset.

ID: 1446424992623828994

http://rysk.finance 08-10-2021 10:40:16

1,1K Tweet

9,9K Followers

15 Following

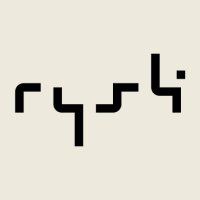

A step-by-step guide to using rysk finance && 🤌 on the Monad Testnet, offering up to 71% APR: 1. Go to app.rysk.finance 2. Connect your wallet (Phantom recommended) and switch to Monad Testnet 3. Earn upfront yield plus staking yield using WMON, sMON, aprMON, shMON, or WETH

Stork X rysk finance && 🤌 Rysk is building a new financial primitive, designed to make covered calls liquid, flexible, and scalable. Their latest product release makes covered calls as easy as picking a target price and receiving yield upfront. Rysk utilizes Stork's low-latency

Rysk Devs are cracked, just see a problem and solve it. A new public good for the Hyperliquid ecosystem. hyperliquid.

Ecosystem Spotlight: Rysk Finance Sustainable yield on ETH, BTC, and volatile assets - finally done right rysk finance && 🤌 is closing DeFi’s biggest gap by introducing liquid, tradable covered calls - a battle-tested TradFi strategy reimagined for crypto Their new financial

Gmonad 💜 A very cool and useful product that very few people use and few people know about. rysk finance && 🤌 – useful onchain options. Crypto options are derivatives that give the right (but not the obligation) to buy or sell a certain amount of cryptocurrency at a predetermined