Saltmarsh Economics

@saltmarshecon

Independent Economic Research

David Owen and Marchel Alexandrovich

Focus on ECB, BoE and Climate Change

ID: 1501247929134325762

http://www.saltmarsheconomics.com 08-03-2022 17:26:33

514 Tweet

262 Followers

405 Following

Latest Bank of England DMP - still not consistent with what is being priced in for UK rates. One year-ahead own output price expectation of firms surveyed 4.3% (compared to one-year ahead CPI expectation of 3.6%), wage expectation 5.2%, employment 1.6%. bankofengland.co.uk/decision-maker…

No significant pivot from the European Central Bank. Inflation forecasts have been revised marginally lower - core inflation in 2026 is now at 2.0% vs 2.1% previously - but the revision is not large enough to signal an imminent rate cut. ecb.europa.eu/press/pr/date/…

Watching the Tides open.substack.com/pub/saltmarshe… Saltmarsh Economics

Europe banks are handing back more of their TLTRO loans. European Central Bank announces a voluntary repayment of €36bn on 27 March. This is in addition to the €215bn maturing on that day. From a peak of €2.2trn, the amount of liquidity being provided to the banks will stand at just €141bn.

Views From the Marsh "STEAM not STEM" - thank you David McClelland. A need to reframe the narrative and move the debate on from how much headroom the Chancellor has to address longer-term issues facing the UK. saltmarsheconomics.substack.com/p/views-from-t…

A more dovish pivot from the Bank of England? 8-1 in favour of keeping Bank Rate at 5.25%, as opposed to a 3-way split of 2-6-1. And a focus from the DMP at looking at the hit to (indebted) businesses from higher rates. More detail to follow on Substack. bankofengland.co.uk/agents-summary…

In our latest note we unpick some of what is currently going on with the European Central Bank balance sheet, what the Governing Council may be looking to achieve over the coming years, and the role that could be played by Green TLTROs and permanent asset holdings. open.substack.com/pub/saltmarshe…

Latest from the UK Office for National Statistics (ONS) - population estimates for mid-2022 and estimates of public service productivity for 2021; as of 2021 still had not (quite) returned to pre-pandemic levels. Will be writing more on such things on Substack.

Our latest note looking at the rise in the minimum wage in the UK, and potential implications for Bank of England. Other recent notes have examined (almost) real time indicators of emissions and a detailed sector breakdown of environmental productivity. saltmarsheconomics.substack.com/p/views-from-t…

It is out! Ben Bernanke's Review of the BoE’s forecasting process and communication policy. From long experience, initial reactions to all such things have a habit of being wrong, or missing the point - so look out for a detailed note from us next week. bankofengland.co.uk/independent-ev…

Another example of UK inflation persistence and forecasting errors, which will not go unnoticed at the Bank of England, running towards their May Monetary Policy Report. More on this from us later in the week.

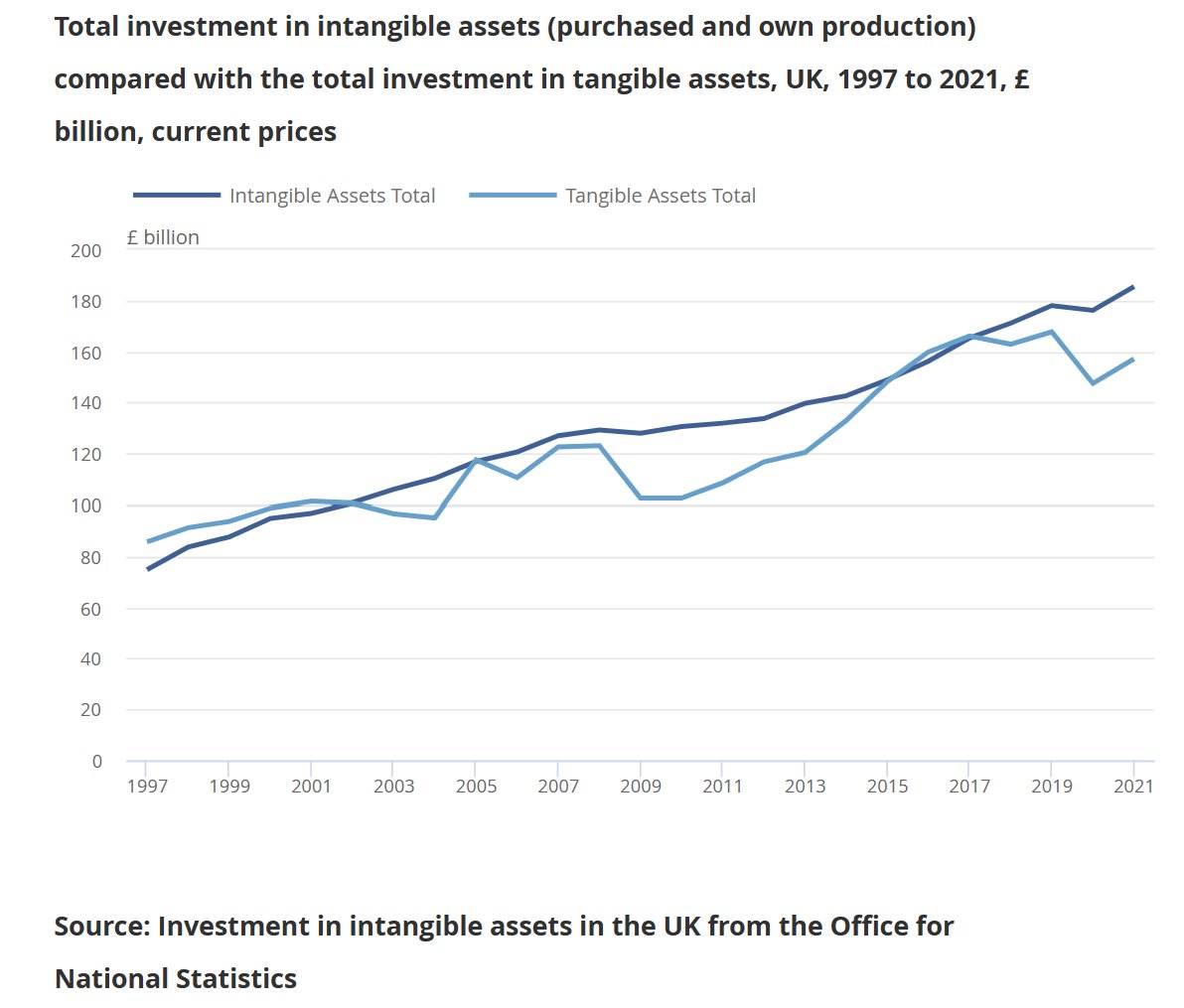

This week, focus of @ukeconomics on Ben Bernanke's Review - please see our note on Substack, still too much attention on forecasting, not enough on communication - and Bank of England and private equity (next FPC Report June). But Office for National Statistics (ONS) again confirmed importance of intangibles.

The markets are reacting to new European Central Bank forecasts: GDP growth revised up for this year, inflation (headline and core) are revised up for 2024 and 2025. But, the Governing Council's main focus will be on the inflation forecasts for 2026 and these are unchanged at 2%.

The European Central Bank is somewhat more cautious than expected in its Monetary Policy statement. In April, it prepared the markets for a 25bp cut in June. However, there was no such explicit guidance for a move in September in today’s announcement. ecb.europa.eu/press/pr/date/…