Jason Saltzman

@saltzman_jason

Head of Insights @cbinsights // Former Professional Cyclist

ID: 4671029228

http://www.cbinsights.com 29-12-2015 04:27:15

1,1K Tweet

439 Followers

845 Following

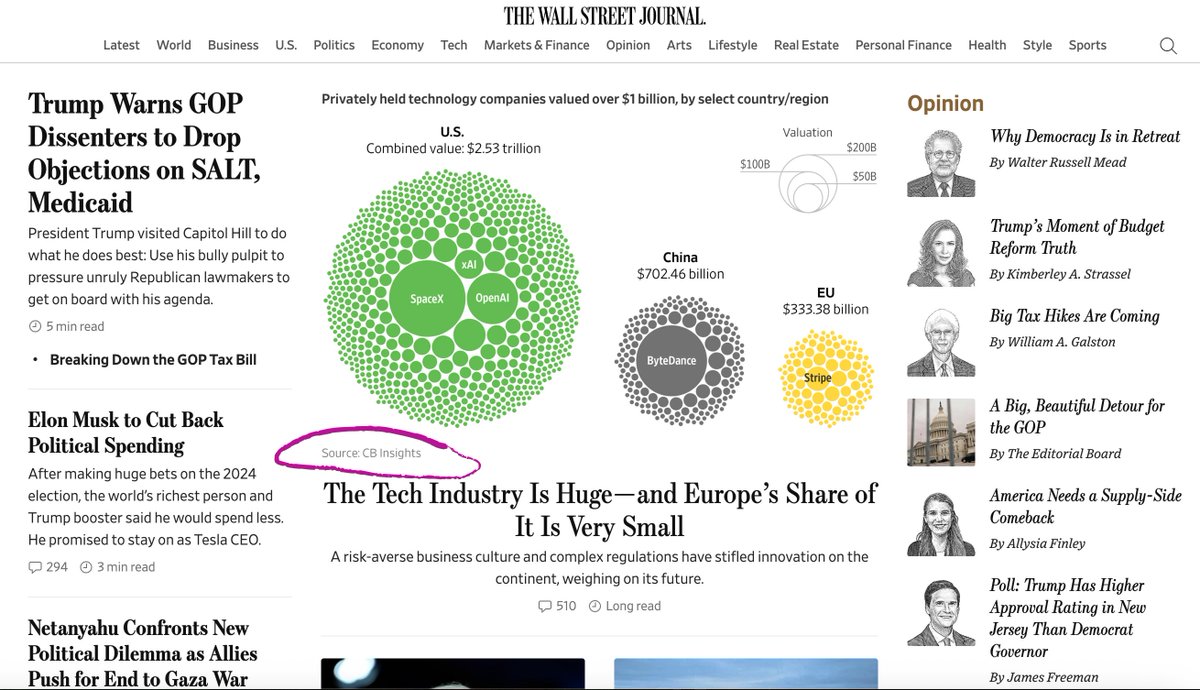

🦄 Unicorns are reaching billion-dollar status earlier than ever Source: CB Insights

AI companies are outperforming and 'outraising' their non-AI counterparts 🤖 That’s the takeaway from Jason Saltzman’s latest visualization: voronoiapp.com/technology/The…

"Why does Europe's tech scene lag?" The answer to Harry Stebbings favorite question to ask European operators and investors is far from simple. And... it is not just that they go on vacation all summer. Is it a money problem or a founder problem? Is it a cultural problem? Is it