Susan Crawford

@scrawford

Author, Senior Fellow at Carnegie DC. Writing about climate adaptation intersections with finance.

On Substack: 'Moving Day,' susanpcrawford.substack.com

ID: 5502502

http://susanpcrawford.substack.com 25-04-2007 16:34:17

6,6K Tweet

21,21K Followers

11,11K Following

How exactly should we read President Trump's meetings with Putin, Zelensky, and European leaders? Andrew S. Weiss weighed in on today's Carnegie Connects. Listen to the full discussion with Andrew, Eric Ciaramella, and Aaron David Miller here: carnegie-connects.simplecast.com/episodes/can-t…

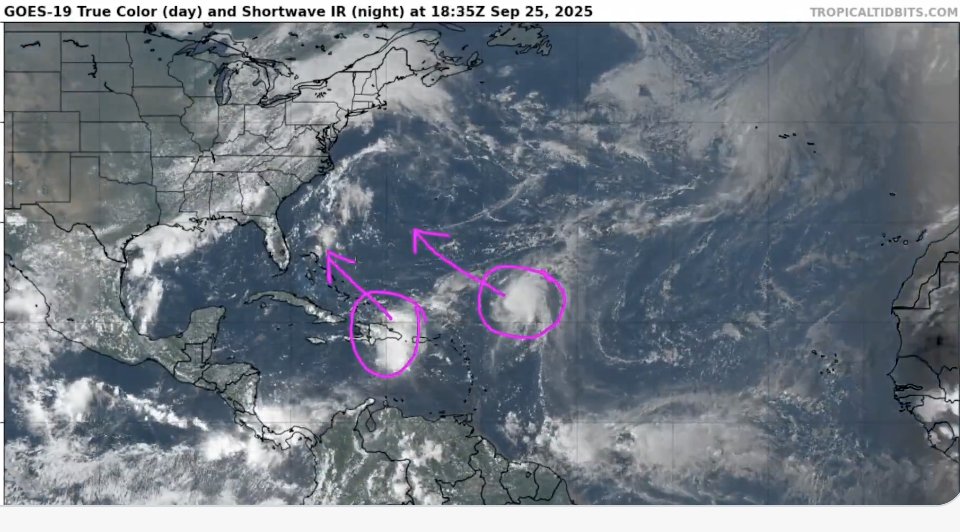

🧵 As Americans grow more vulnerable to extreme weather and natural disasters, the country’s infrastructure will have to adapt. In two new Carnegie papers, Susan Crawford explains what’s at stake and charts a path forward ⬇️

Markets’ capital allocation functions are distorted because we fail to demand impact risk pricing. Excellent example Susan Crawford: credit scores, not physical risk, drive insurance. But, higher credit scores subsidized to live in disaster risk areas. Why? susanpcrawford.substack.com/p/how-insuranc…

Rob Majteles Susan Crawford Distortion in insurance pricing is just one symptom of a broader issue - our failure to accurately price risk. This has far-reaching implications for capital allocation, as Majteles pointed out.

"It is just mind-numbing that there's just so little attention on the credit side in terms of this [climate] risk in the municipal bond market," Tom Doe of Municipal Market Analytics told Susan Crawford #munibonds

What will it take for investors to price any climate risk, anywhere? “Betting on bonds, ignoring climate risk: mind-numbing that there's just so little attention on the credit side in terms of this [climate] risk in the municipal bond market” Susan Crawford susanpcrawford.substack.com/p/betting-on-b…