shantanu srivastava

@shantanusri23

Sustainable Finance and Climate Risk Lead at the Institute for Energy Economics & Financial Analysis (IEEFA)

ID: 1453237521505308685

27-10-2021 05:50:21

295 Tweet

172 Followers

141 Following

🇮🇳Indian #powersector has long contributed to the country’s NPA problem. Despite govt’s efforts, the sector still faces challenges. shantanu srivastava via Power Line talks about repowering assets, NPAs in the power sector and strategies for resolving them. tinyurl.com/22xb684d

🇮🇳India has a large pool of capital from institutional investors which we have not been able to mobilize into the #cleanenergy sector in a material way, says shantanu srivastava at "Financing India's Sustainable Energy Transition" webinar. #IIM-C

TataPower's commitment to decarbonisation is a visionary blueprint that has the potential to transform India's energy landscape & inspire a new era of sustainable progress #OpEd by shantanu srivastava, IEEFA South Asia's Sustainable Finance & Climate Risk Lead bit.ly/3sBr3IQ

We need to create processes for capturing climate risk metrics in bank lending ops. Upskilling workforce, and a governance structure will ensure these changes are enforced, says shantanu srivastava via Mongabay India | Simrin Sirur tinyurl.com/2vrja4ra

Tata Power is emerging as a beacon of hope towards a cleaner, more #sustainableenergy landscape. Its commitment to #decarbonise its portfolio by 2045 exemplifies the forward-thinking approach that is desperately needed- shantanu srivastava via Energy Tracker Asia tinyurl.com/3r4e6xx5

Sabyasachi Majumdar, ICRA Kushaagra Nandan, SunSource Energy Dibirath Sen, HSBC India Manish Dabkara, @EKIEnKing shantanu srivastava, IEEFA.org Akhil Agarwal, ST Telemedia Global Data Centres (India)

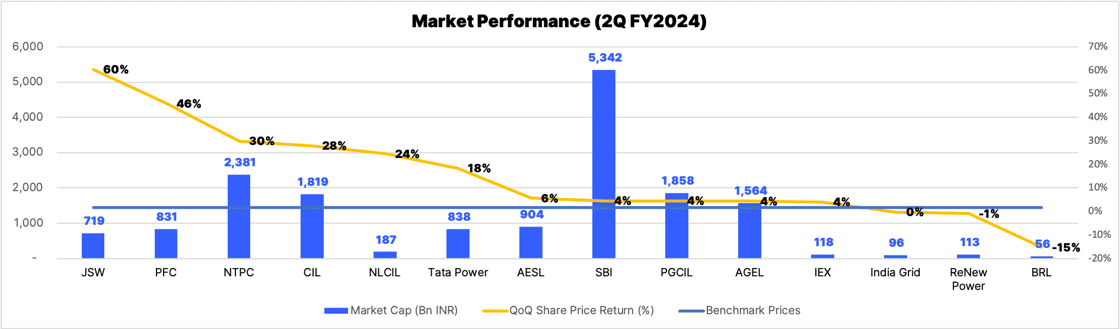

PowerPulse presents a quarterly review of several publicly listed firms in India's #power sector. An overview of these entities would be valuable for those tracking India's #climatechange progress. | shantanu srivastava | Subscribe to the newsletter ➡️tinyurl.com/rumaaspm

PowerPulse presents a quarterly review of several publicly listed firms in India's #power sector. An overview of these entities would be valuable for those tracking India's #climatechange progress. | shantanu srivastava | Subscribe to the newsletter ➡️tinyurl.com/rumaaspm

"Investing in India's Just Transition - Between Potential and Practice" webinar was organised by Germanwatch on October 16.IEEFA South Asia's shantanu srivastava participated in the event as a speaker. Below is one of his top quotes from the webinar.

Today, some of the world's biggest firms, with a combined annual revenue of US$26.4 tn, have net-zero targets. However, these net-zero targets have raised greenwashing concerns among stakeholder- shantanu srivastava via ETEnergyWorld Read the analysis👉: tinyurl.com/t2tdz58y

2nd edition of PowerPulse newsletter presenting quarterly review of publicly listed power firms in India. It would be valuable for those tracking India's #climatechange progress.|shantanu srivastava |Click to read ➡️tinyurl.com/2e5f477d |Subscribe➡️ tinyurl.com/b2fy73at

🚨Event alert! Attend session on "Risks at the Margin: Financing for Micro, Small, and Medium Enterprises" in which IEEFA South Asia's shantanu srivastava is speaker. | 📅Date: 29 Feb | | ⏲Time: 14:30 - 15:45 hrs IST | 🏨Venue –Eros Hotel, Delhi | Register: feedconference.in

Both South and Southeast Asia offer many opportunities for global climate action, with many govts setting ambitious net-zero targets, says @Shantanusri23 in his latest opinion piece in The Third Pole. Read the full article➡️tinyurl.com/7dvmh4km | Top quotes from the article⬇️: