St. Louis Fed

@stlouisfed

Official Federal Reserve Bank of St. Louis account. We share economic data and insights. Home to FRED®, @FedFRASER & @FedHistory

ID: 71567590

http://www.stlouisfed.org/ 04-09-2009 15:57:18

52,52K Tweet

234,234K Followers

37 Following

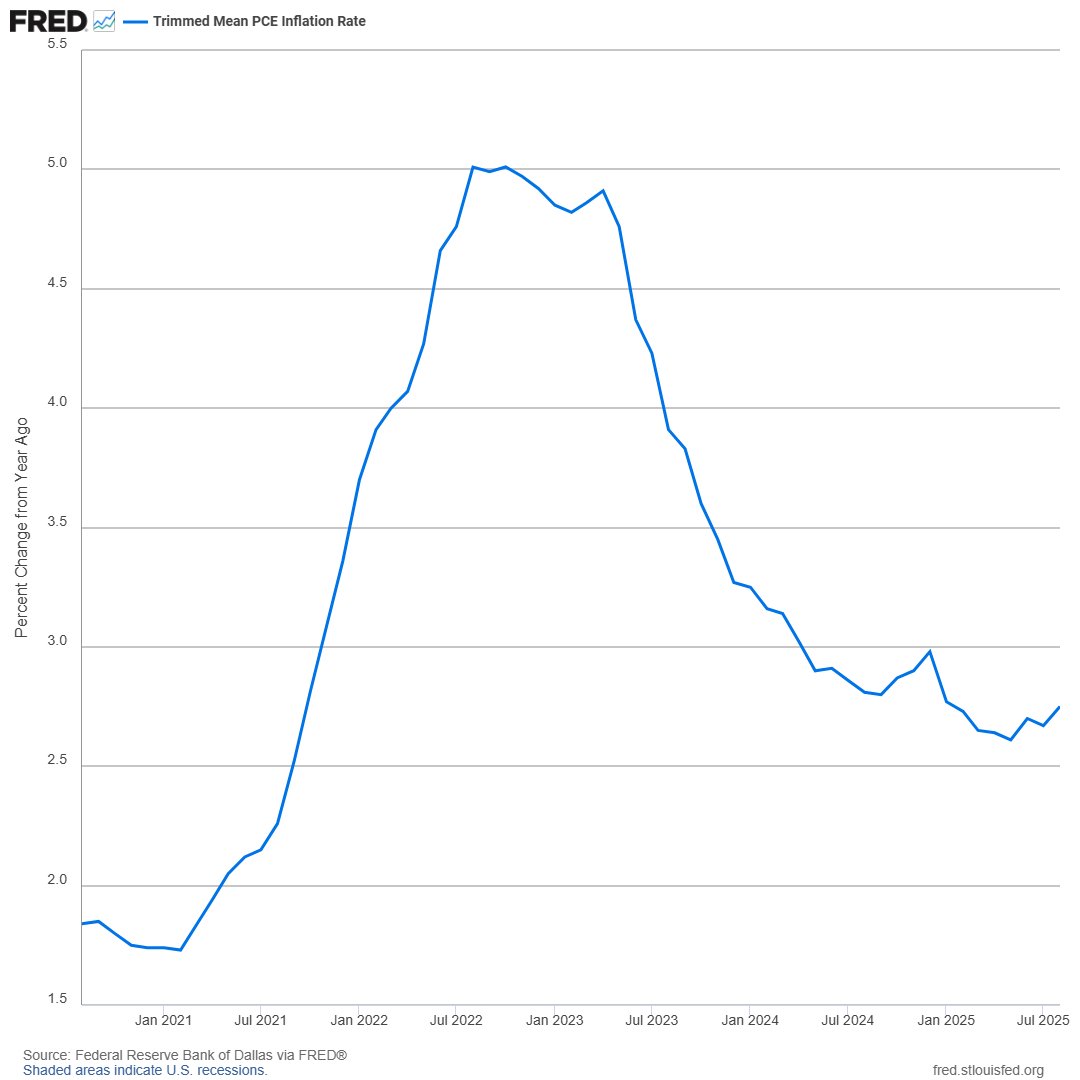

Trimmed mean PCE inflation rate, an alternate measure of core inflation from Dallas Fed, was 2.75% for the 12 months ending in August, little changed from July bit.ly/42fngA6

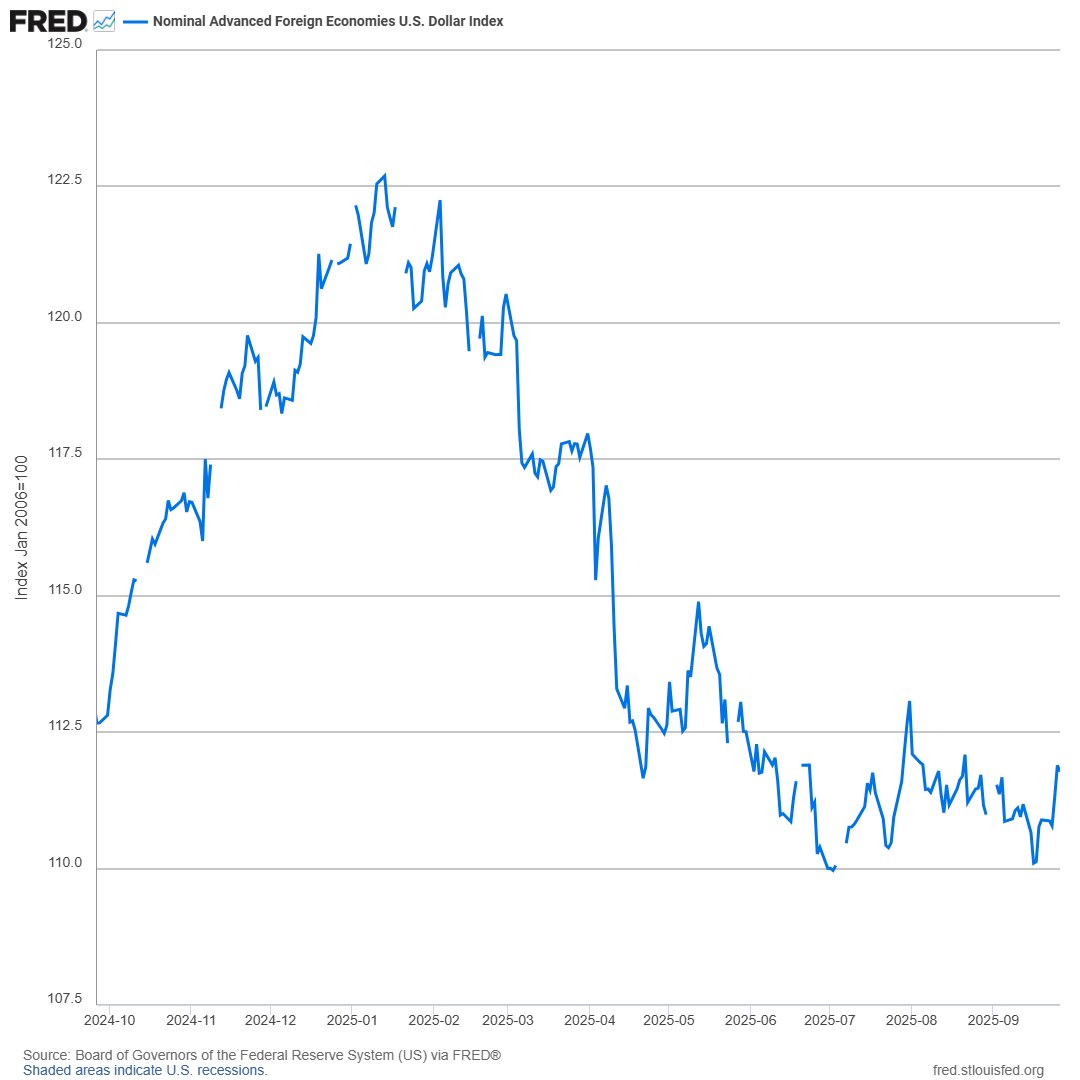

The daily trade-weighted U.S. dollar index was measuring 111.8 as of Sept. 26 (January 2006=100). Want to track this index or other foreign exchange rates from Federal Reserve? See FRED: bit.ly/3IGBmE3

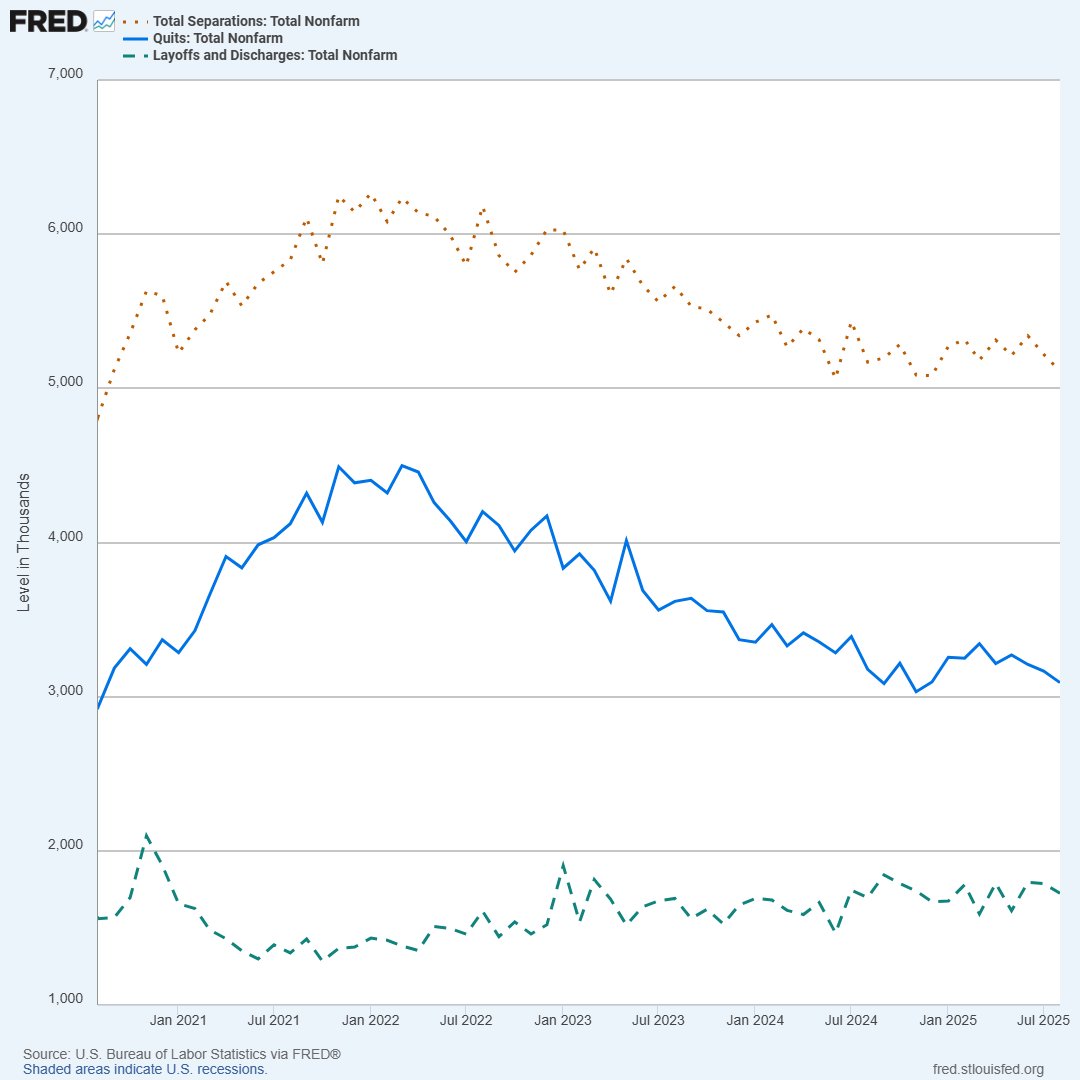

See FRED for the latest BLS-Labor Statistics data on job openings by census region and sector #JOLTS bit.ly/4pTiG4M