SussexLC.Group

@sussexlc

Innocent #Sussex folk fighting for their 'LIVES' against #APN's and #LoanCharge injustices #STOPtheLoanCharge #SaveLives #GE2024

ID: 1527033230213406720

18-05-2022 21:08:22

41,41K Tweet

978 Followers

2,2K Following

A pleasure to contribute to Money Talks from Headlinemoney I rant about the #loancharge and reminisce about my encounters with the Calendar Girls, Sooty and Sweep and Nora Batty. Thanks again for the opportunity. The Yorkshire Post headlinemoney.co.uk/posts/greg-wri…

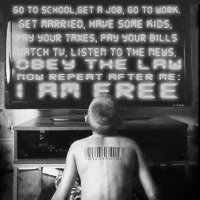

How is it right to retrospectively apply punitive legislation in ways which individuals could not be expected to foresee or prepare for? Loan Charge Action Group [LCAG] Loan Charge & Taxpayer Fairness APPG #LoanChargeScandal

![Loan Charge Impact (@lc_impact) on Twitter photo How is it right to retrospectively apply punitive legislation in ways which individuals could not be expected to foresee or prepare for?

<a href="/LCAG_2019/">Loan Charge Action Group [LCAG]</a>

<a href="/loanchargeAPPG/">Loan Charge & Taxpayer Fairness APPG</a>

#LoanChargeScandal How is it right to retrospectively apply punitive legislation in ways which individuals could not be expected to foresee or prepare for?

<a href="/LCAG_2019/">Loan Charge Action Group [LCAG]</a>

<a href="/loanchargeAPPG/">Loan Charge & Taxpayer Fairness APPG</a>

#LoanChargeScandal](https://pbs.twimg.com/media/GxFLzkPXMAAunvD.png)

Loan Charge Impact Loan Charge Action Group [LCAG] Loan Charge & Taxpayer Fairness APPG Technically, Govt can do this. But Parliament intention for tax retrospection is to only apply it in limited and specific circumstances - and there is a formal review process for that. Tory Govt and HMRC colluded to ignore this, bypass safeguards and call it retroactive instead.

Loan Charge Impact Loan Charge Action Group [LCAG] Loan Charge & Taxpayer Fairness APPG #LoanCharge is clearly retrospective in effect, aimed not at limited and specific circumstances, but belatedly at widespread industry arrangements across multiple professions, that emerged after #IR35 uncertainty. It failed to stop loan schemes, as it only targeted workers.

Loan Charge Impact Loan Charge Action Group [LCAG] Loan Charge & Taxpayer Fairness APPG Through several #LoanCharge reviews, HMT and HMRC have refused to acknowledge responsibility for causation and exacerbation of loan scheme proliferation in large part arising from their inaction and belated actions. Instead they have doubled down on keeping workers in the frame.

Loan Charge Impact Loan Charge Action Group [LCAG] Loan Charge & Taxpayer Fairness APPG iAt the least, it's morally wrong when Tax payers should have certainty on their liabilities! Retrospective Tax takes away any certainty or ability to plan.HM Revenue & Customs make up the rules as they go along & have breached the 'Rule of law' in doing so, they failed their duty of care

Irene Campbell MP Scottish Government The SNP Steve Witherden MP ExcludedUK Gordon Brown If you have mislaid our many invitations to join APPG Gaps in Covid-19 Financial Support Irene i have attached it here. If you want to discuss this with me first on behalf of your #ExcludedUK in Nth #Ayrshire & #Arran i will be outside The Labour Party Party conference in September. x.com/ExcludedUK/sta…

Day 1,662 : Ten #LoanChargeSuicides Treasury Committee & Meg Hillier why are you not investigating the #LoanChargeScandal ? Keir Starmer Angela Rayner Rachel Reeves Darren Jones MP James Murray Spencer Livermore #StopTheLoanCharge ⚖️ The Times and The Sunday Times George Greenwood 👇🏻

NOW 373 DAYS since our nuclear test veterans - national heroes in their eighties - requested a meeting with Prime Minister Keir Starmer to discuss how he will honour the commitment Labour made to their campaign for justice and compensation in opposition. The nuked blood

Mel C Loan Charge Impact Loan Charge Action Group [LCAG] Loan Charge & Taxpayer Fairness APPG HM Revenue & Customs The #LoanChargeScandal and other agressive behaviour from #HMRC is living proof why the UK needs a #Taxpayers Bill of Rights to protect citizens from HMRC overreach. #TaxpayersBillOfRights

Mel C Loan Charge Impact Loan Charge Action Group [LCAG] Loan Charge & Taxpayer Fairness APPG HM Revenue & Customs Meanwhile, as if to prove how everyone is treated the same...all individual taxpayers have to do is to grow "too big to fail" or be taxed. x.com/paullewismoney…

Wow, HM Revenue & Customs really outdid themselves with the Loan Charge! Retroactively taxing folks for schemes they were told were legit? Pure genius. 😒 #LoanChargeScandal #HMRCHustle #TaxTrap

Day 1,663 : Ten #LoanChargeSuicides Treasury Committee & Meg Hillier why are you not investigating the #LoanChargeScandal ? Keir Starmer Angela Rayner Rachel Reeves Darren Jones MP James Murray #StopTheLoanCharge ⚖️ The Times and The Sunday Times George Greenwood 👇🏻

Marion Treasury Committee Meg Hillier Keir Starmer Angela Rayner Rachel Reeves Darren Jones MP James Murray The Times and The Sunday Times George Greenwood So lucky then, to have an ex-HMRC and ex-CIOT president presiding over the latest narrowly defined Terms of Reference (non-) #LoanCharge Review. Which curiously omit scrutiny of recruitment agencies, accountants and tax advisers... #LoanChargeScandal

![Loan Charge Action Group [LCAG] (@lcag_2019) 's Twitter Profile Photo Loan Charge Action Group [LCAG] (@lcag_2019) 's Twitter Profile Photo](https://pbs.twimg.com/profile_images/993517859354619905/lIfW2JQm_200x200.jpg)

HM Revenue & Customs Social workers and all honest people would have nothing to fear if HM Revenue & Customs fulfilled it's statutory duty. This is a farce James Murray Rachel Reeves

HM Revenue & Customs Shame you don't publish the amount of tax losted due to non-complaint umbrella companies due to the offpayroll rules

HM Revenue & Customs Rather than allowing these companies to continue with targeting vulnerable, honest, hard working people that do not understand the tax system, why don't you target the companies and close them down. (I.e. not let it drag on for years, and then target the workers (ring any bells?)

HM Revenue & Customs As it is, loan promoters and loan scheme enablers have had nothing to fear for decades, while HMRC transferred tax liability to workers. Going after the former would have opened that strategy to challenge, as HMRC officials have admitted in earlier FOI internal correspondence.