Michael Svoboda

@svobodamichael

CEO, Liquity AG. 100% DeFi-native borrowing and stablecoins with @LiquityProtocol V1 & V2.

ID: 113275016

https://www.liquity.org/ 11-02-2010 07:25:42

559 Tweet

1,1K Followers

797 Following

Voting is now live on Curve Finance to assign gauges for the $BOLD pools: • BOLD / USDC 👉 curve.finance/dao/ethereum/p… • BOLD / LUSD 👉 curve.finance/dao/ethereum/p… Your support is appreciated 🙏

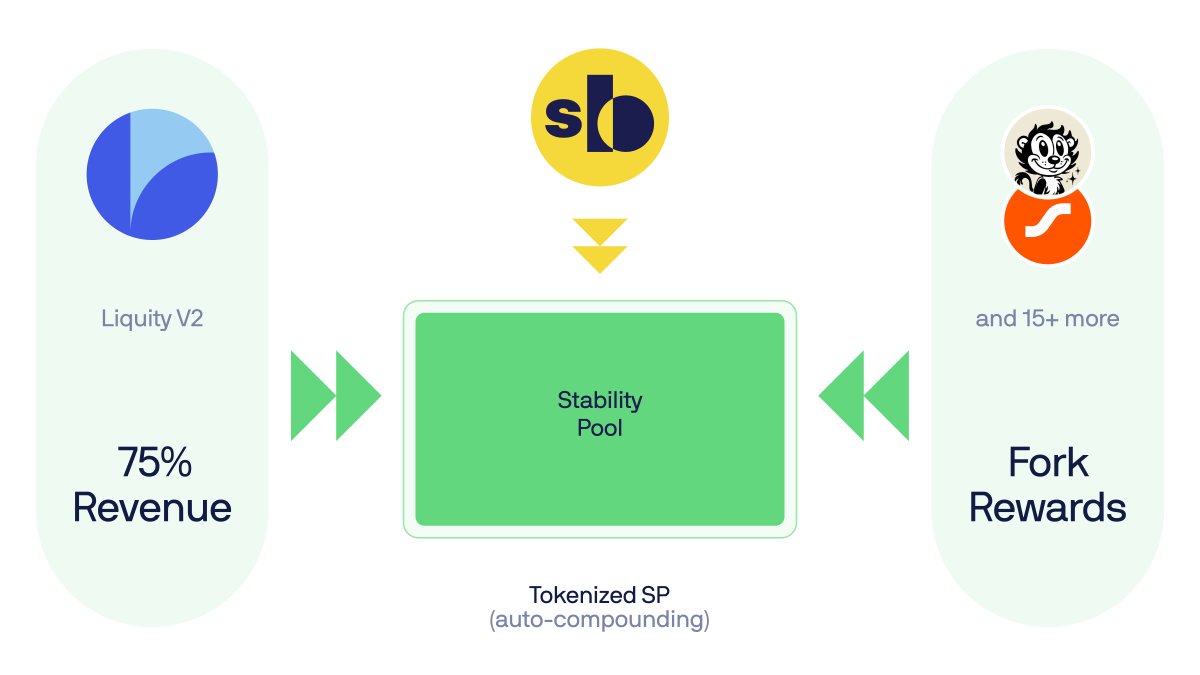

BOLD and sBOLD are now live on Euler Labs - Borrow USDC/USDT without selling BOLD or sBOLD - Loop with organic, auto-compounding sBOLD yield - Multiply your exposure to 20+ fork airdrops Borrow, loop, and earn Let’s break it down 👇