Tactyc by Carta

@tactychq

Tactyc by Carta is the first forecasting and planning software for VCs. Portfolio construction, management and reporting in one platform. No spreadsheets.

ID: 1276307731641556993

https://tactyc.io 26-06-2020 00:14:16

590 Tweet

958 Followers

276 Following

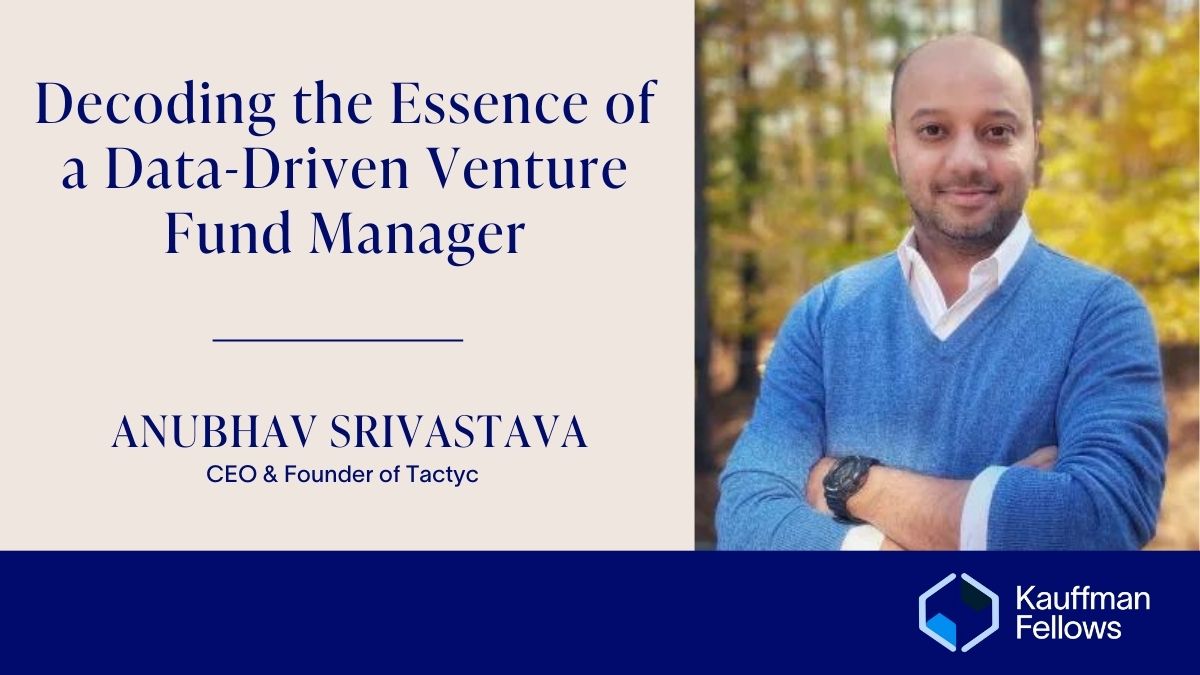

Check our our CEO and Founder Anubhav Srivastava on the @10XCapitalVC Podcast now!

What does it mean to be “data-driven” in venture portfolio management and planning? Yesterday, Anubhav Srivastava of Tactyc by Carta’s workshop dove into fund forecasting, scenario analysis, optimizing reserves based on objective metrics, and tracking KPIs.

Here's how to market a fund and increase the surface area of serendipity for yourself and your founders: 1. Throw a party with Mercury Harmonic and Tactyc by Carta at your house during Upfront Ventures Summit week when all the top tier VCs fly in. More 👇

Join Tactyc and The European VC for an advanced session on VC Portfolio Management, focusing on Capital Deployment and Reserve Planning. This workshop will dive deep into strategic capital deployment and explore effective reserve planning to optimize portfolio performance. We'll

This partnership brings us closer to building a truly comprehensive suite for private fund management, and we couldn’t be more excited for the journey ahead. Welcome to the team, Anubhav, Michelle, Shane, and everyone at Tactyc by Carta 🎉