Mihai Grigore 🚀

@tech_metrics

Techie on valuable metrics. Doer. To the point

ID: 756056029

https://www.mihaigrigore.com 13-08-2012 23:43:16

256 Tweet

2,2K Followers

1,1K Following

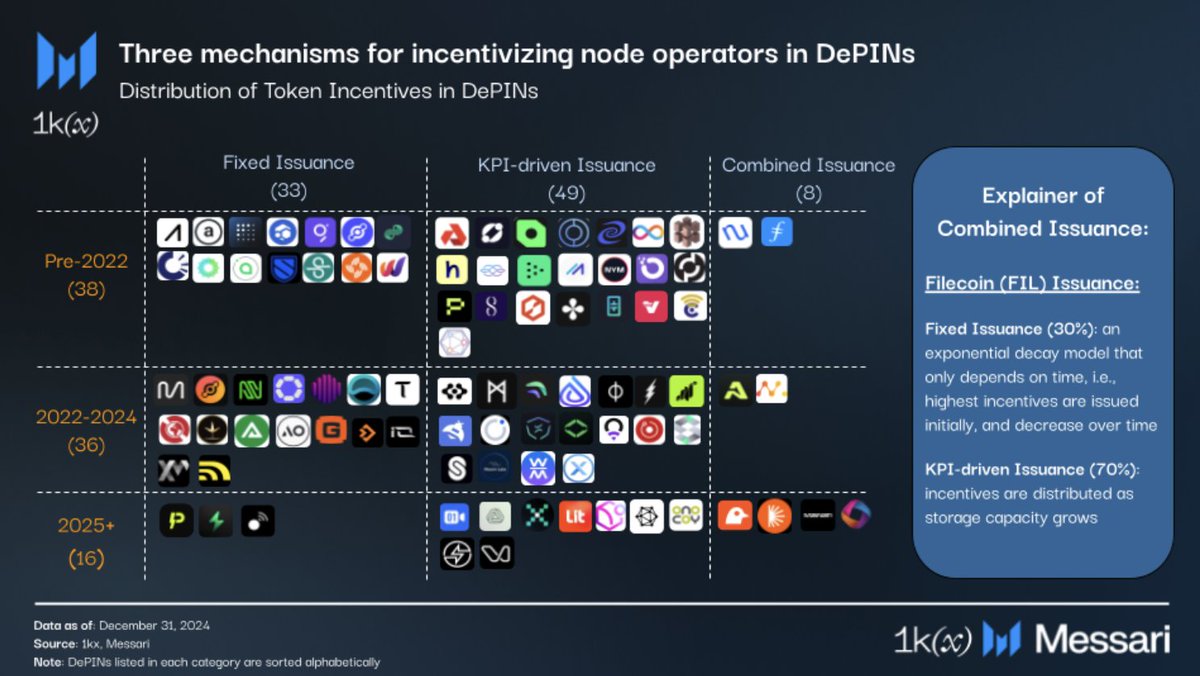

We 1kx just published our first report on DePIN tokenomics with Dylan Bane and Mihai Grigore 🚀 from Messari, starting with an analysis of incentive mechanisms on 100+ DePINs 🧵

gm gm ☀️🇨🇭 seems that there’s quite a small world after all, even here at CfC St. Moritz 😎😎🤓

After a full day with Joseph Lubin l, glad to meet those 2 legends Stefan George 🦉💳 from Gnosis 🦉 GnosisVC and Mihai Grigore 🚀 from Messari at CfC St. Moritz, always learning a ton 👏

Most DePINs require "skin-in-the-game": - Digital Resource Networks primarily use a Stake for Access token incentive model; - Physical Resource Networks primarily use a Node-Purchase model. Check my research w/ Robert Koschig (1kx) & Dylan Bane (Messari) below:

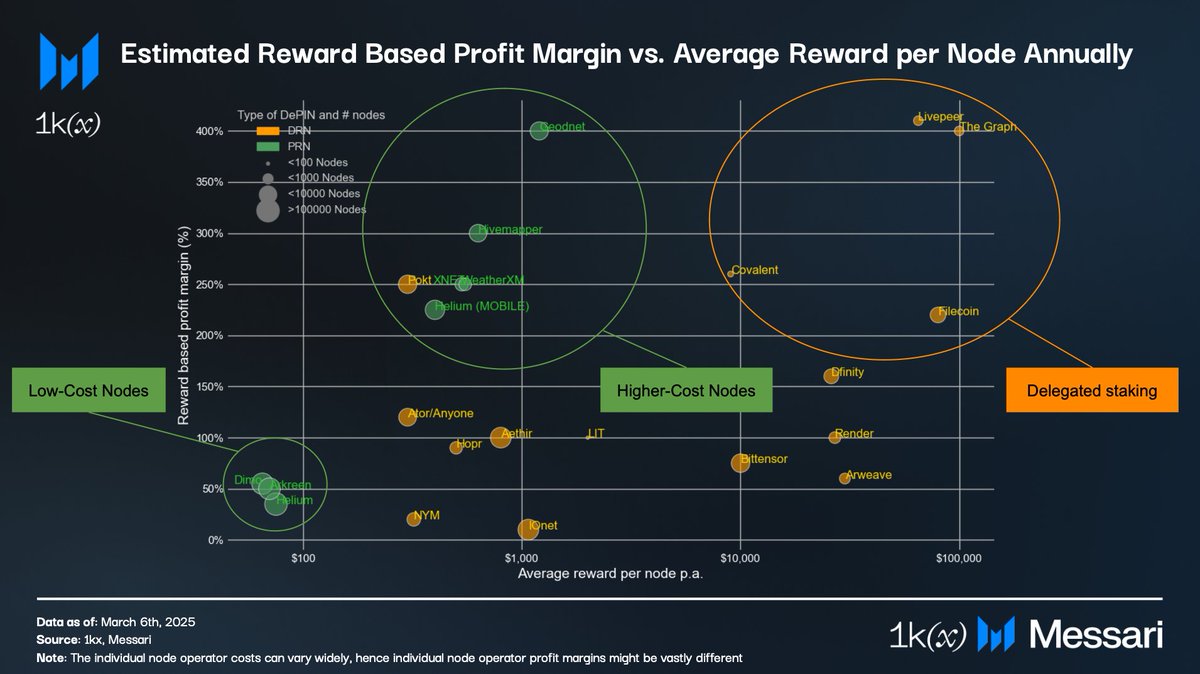

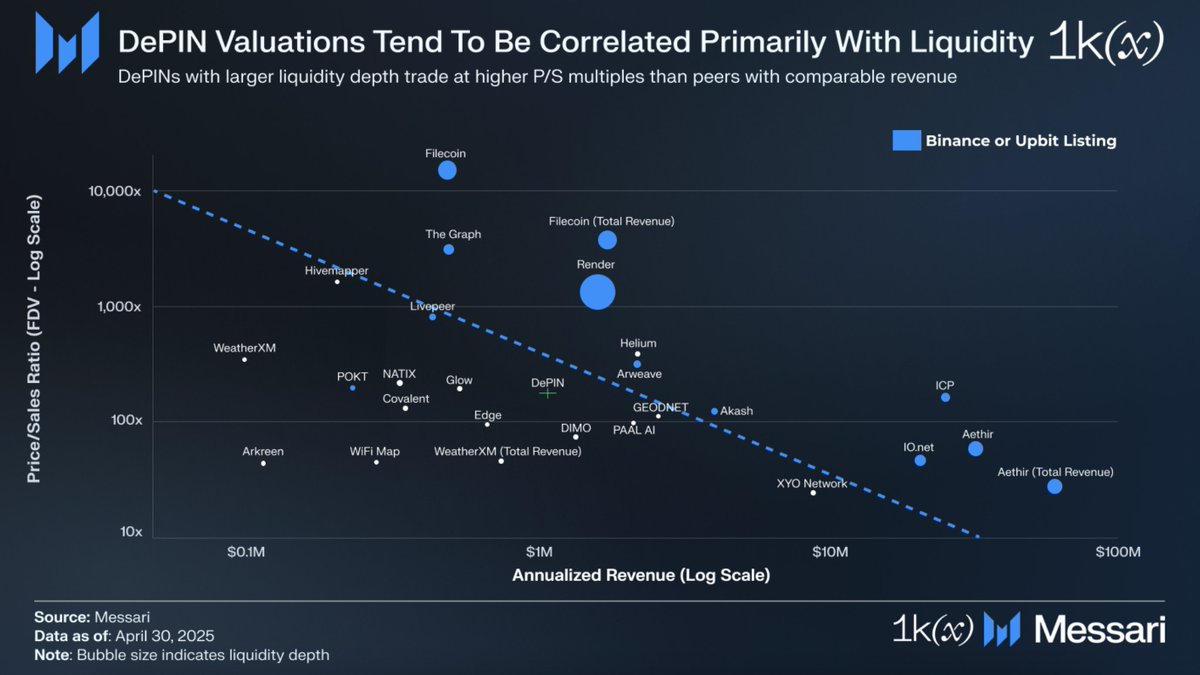

Today, we 1kx release Part 2 of our DePIN Tokenomics Series with Dylan Bane and Mihai Grigore 🚀 from Messari. We analyzed the reward mechanisms of 27 DePINs - here's what the data reveals 🧵

🚀 VC Panel ETH Bucharest 🇷🇴 “Let’s get ugly quickly & make mistakes early.” 🧠 AI x Blockchain = coordination power 👩🚀 Founders: obsession > code. Being technical isn’t a must anymore! 🎮 GameFi: big potential, but we’re early. Gamers resist switching games or adopting