Tobias van Amstel

@tobiasvanamstel

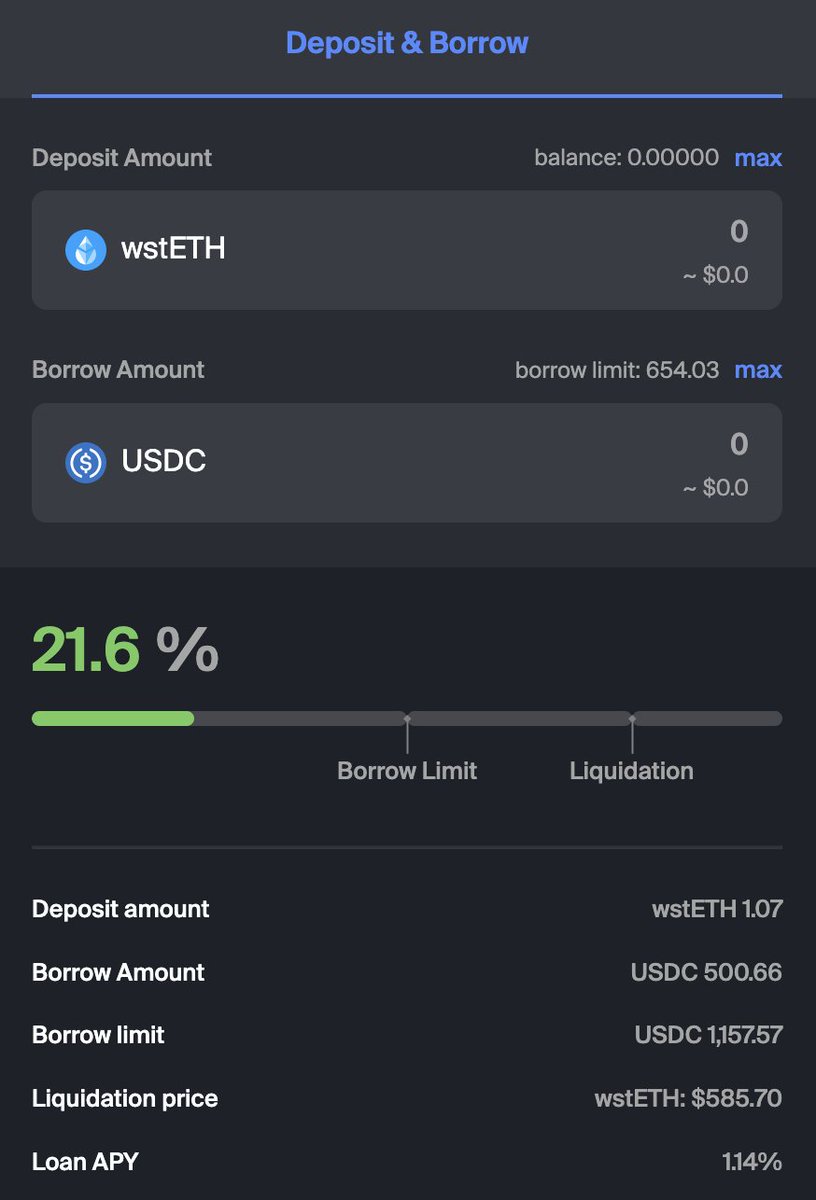

Co-founder & CEO Altitude Labs - @AltitudeFi_

ID: 22126735

27-02-2009 10:17:19

339 Tweet

369 Followers

493 Following

Less than 24 hours to go! RWA vs DeFi: Friends or Foes? 🎙️ Jigsaw, Polytrade & Tobias van Amstel dive deep tomorrow at 4pm UTC. DeFi Summit Talks by Altitude.Fi — unfiltered alpha only. Set your reminder 👇 x.com/i/spaces/1ypJd…

☁️ Renka (ѱ,ѱ) Appreciate the kind words🙏