Truflation

@truflation

Decentralized Infrastructure (RWA, Indexes, & Inflation 30M+ Data Pts) 80+ Providers, Censorship-Resistant, Transparent | $TRUF

ID: 1465216173612871681

https://linktr.ee/truflation 29-11-2021 07:11:19

17,17K Tweet

123,123K Followers

1,1K Following

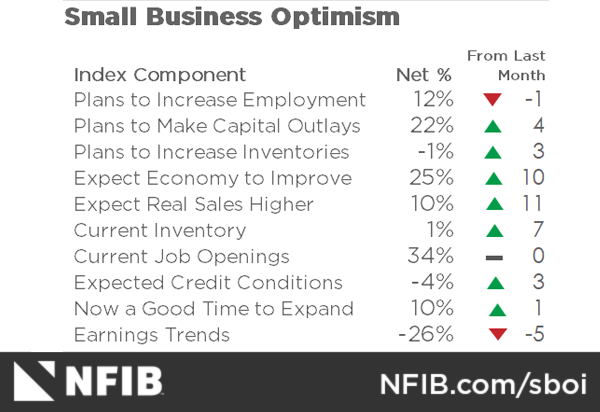

Inflation is not completely under control! PPI: 2.6% Just like the CPI, there was a slight increase in the PPI in May. Want to have access to updated data on inflation? Follow Truflation

Economic on-chain data needs to be refined 📈 This is what TRUF.NETWORK does better than anyone else!

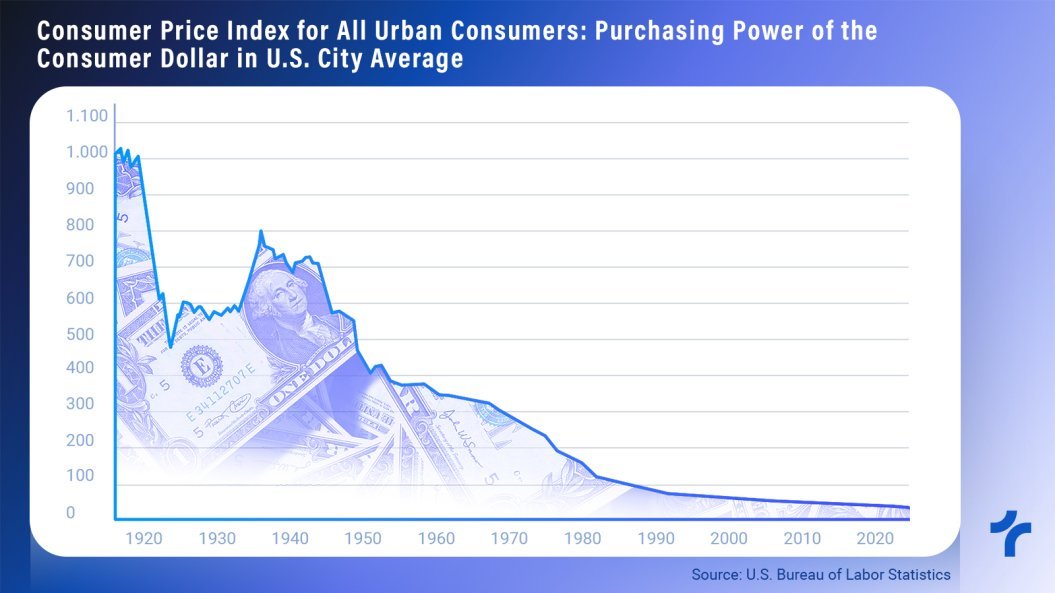

More transparency, efficiency, and lower costs. This is why the US government should use Truflation's inflation data!

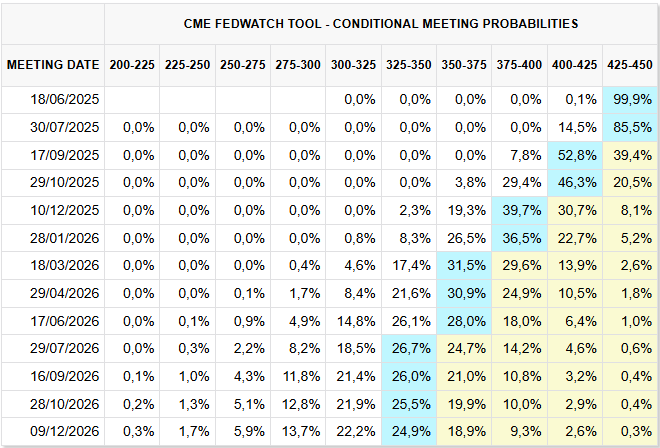

🧠TRUF.NETWORK just dropped a blog on how one could leverage a 45-day lead on inflation trends. We can’t confirm what our institutional clients are doing (👀), but we can share some sharp examples. Spreading the TRUF — from institutional desks to everyday investors. 🫡

Inflation is back above 2%! Today, the Truflation Inflation Index is pointing to inflation at 2.08%. The main driver of the increase was Household & daily items, which went from 2.43 to 4.09% (YoY). Do you believe inflation will stabilize or continue to rise? 👇

Decentralization is building a reality you don’t have to trust, because you can verify it. It's about connecting the whole world in real time. That’s what TRUF.NETWORK does with economic data.

What Bitcoin is doing to money, TRUF.NETWORK will do to data!