Watt

@wattprotocol

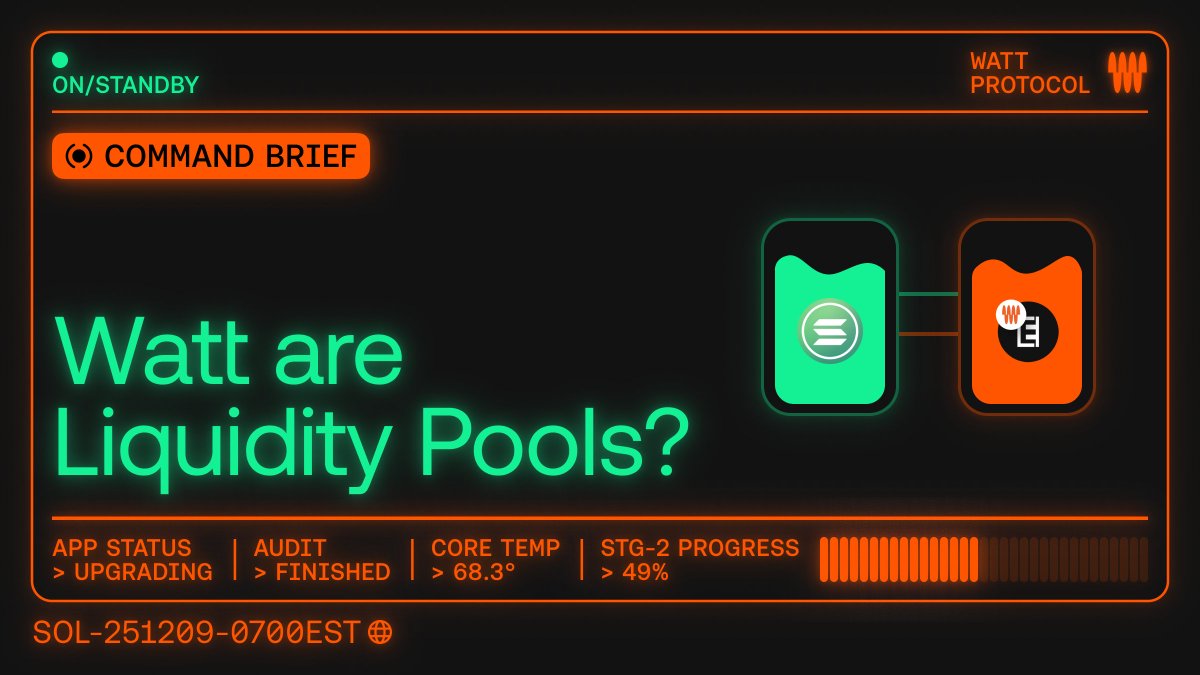

Transforming your Solana tokens into yield-generating assets with universal staking. 💥

@Colosseum winner 🏆 DeFi track & Accelerator member

ID: 1805944904796807168

https://discord.gg/cChe5CwQrh 26-06-2024 12:43:42

2,2K Tweet

3,3K Followers

63 Following

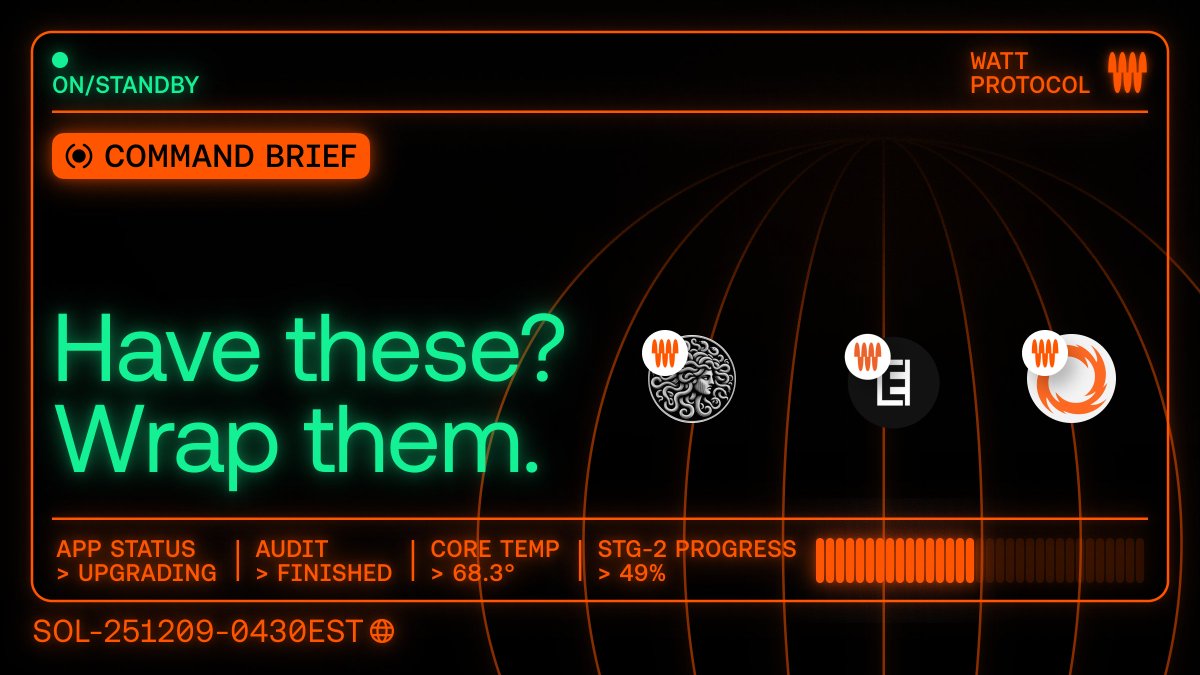

We've worked and listed 3 amazing teams so far: > Loyal > Epicentral Labs > Turbine Cash Are these sitting in your wallet getting dusty? Say no more. Wrap them ⚡️

Abu Dhabi, we are plugged in ⚡️ Watt is heading to Solana Breakpoint 🇦🇪 Abu Dhabi Dec 11-13 to push the future of yield-powered assets. If you are building on Solana, obsessed with liquidity, or curious about how volatility becomes real-time yield, let’s talk!