Gordon Berry

@wealthagent

Business Adviser. Chartered Certified Accountant and Chartered Tax Adviser. NLP Master Practitioner.

ID: 301075537

https://armadillo-support.co.uk/ 18-05-2011 20:50:58

43,43K Tweet

1,1K Followers

1,1K Following

James Tewes Two genuine & serious questions for you: 1. What part do you think doesn’t hold up legally? 2. What do you think they’d pursue from those who promoted schemes? I ask as I genuinely think people are being missold the answer to those two questions right now, so I do want to know.

We have long argued that HM Revenue & Customs cannot simultaneously hold two different positions for different taxes when seeking IHT on payments treated as earnings. Here the FTT agree with us, holding that there was "no basis for this position": caselaw.nationalarchives.gov.uk/ukftt/tc/2025/…

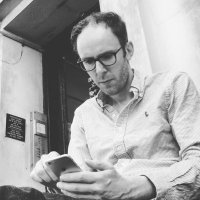

LoanChargeHell Armadillo - Tax Support HM Revenue & Customs There are some people out there who actually believe that WTT are eventually, one day perhaps this century, going to start a new case at the FTT despite rulings already given at the Supreme Court & Court of Appeal. Yet when you point this out this absurdity they argue with you🤷♂️

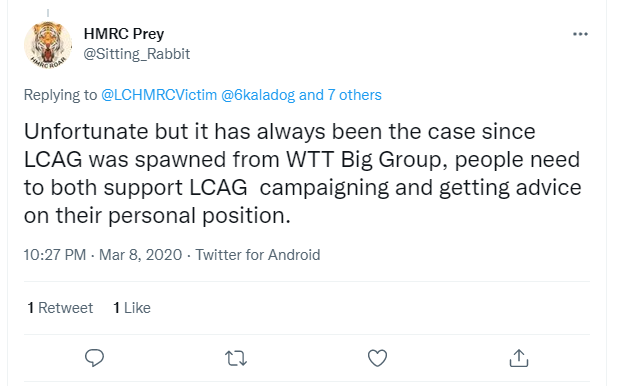

Loan Charge Action Group [LCAG] HM Revenue & Customs James Murray Rachel Reeves Ray McCann LCAG seem to want to benefit from a tax avoidance scheme if it works, but not be the ones to lose out if it doesn't work. This is the same LCAG who argue that without retrospection no tax is due. LCAG should be highlighting the draconian "punishment strategy" settlement terms.

![Gordon Berry (@wealthagent) on Twitter photo <a href="/LCAG_2019/">Loan Charge Action Group [LCAG]</a> <a href="/HMRCgovuk/">HM Revenue & Customs</a> <a href="/jamesmurray_ldn/">James Murray</a> <a href="/RachelReevesMP/">Rachel Reeves</a> <a href="/Ray_McCann55/">Ray McCann</a> LCAG seem to want to benefit from a tax avoidance scheme if it works, but not be the ones to lose out if it doesn't work.

This is the same LCAG who argue that without retrospection no tax is due.

LCAG should be highlighting the draconian "punishment strategy" settlement terms. <a href="/LCAG_2019/">Loan Charge Action Group [LCAG]</a> <a href="/HMRCgovuk/">HM Revenue & Customs</a> <a href="/jamesmurray_ldn/">James Murray</a> <a href="/RachelReevesMP/">Rachel Reeves</a> <a href="/Ray_McCann55/">Ray McCann</a> LCAG seem to want to benefit from a tax avoidance scheme if it works, but not be the ones to lose out if it doesn't work.

This is the same LCAG who argue that without retrospection no tax is due.

LCAG should be highlighting the draconian "punishment strategy" settlement terms.](https://pbs.twimg.com/media/GuNY0zrXwAAQNYf.png)

Gordon Berry Loan Charge Action Group [LCAG] HM Revenue & Customs James Murray Rachel Reeves Ray McCann Different words but to the same tune. Contradictory nonsense and whoever they’re listening to is misleading them. Which is somewhat ironic!

James Tewes Here is a true irony. People are being sold the sort of claims you are repeating. Yet these claims are being: 1. sold contrary to the clear legal position; 2. sold to people in dire financial straits; 3. promoted by the lobby group LCAG to the very people it's meant to represent!

Who is writing these Loan Charge & Taxpayer Fairness APPG letters & totally misleading both Loan Charge Action Group [LCAG] & the APPG?