Employ America

@employamerica

Monetary + fiscal policies that boost employment, wages and job quality.

Follow our team: @IrvingSwisher @ArnabDatta321 @vebaccount @ash_georgexx @PrestonMui

ID: 1100956314778456064

https://employamerica.org/ 28-02-2019 03:10:14

1,1K Tweet

5,5K Followers

714 Following

Is there any anti-recession advocacy group besides Employ America

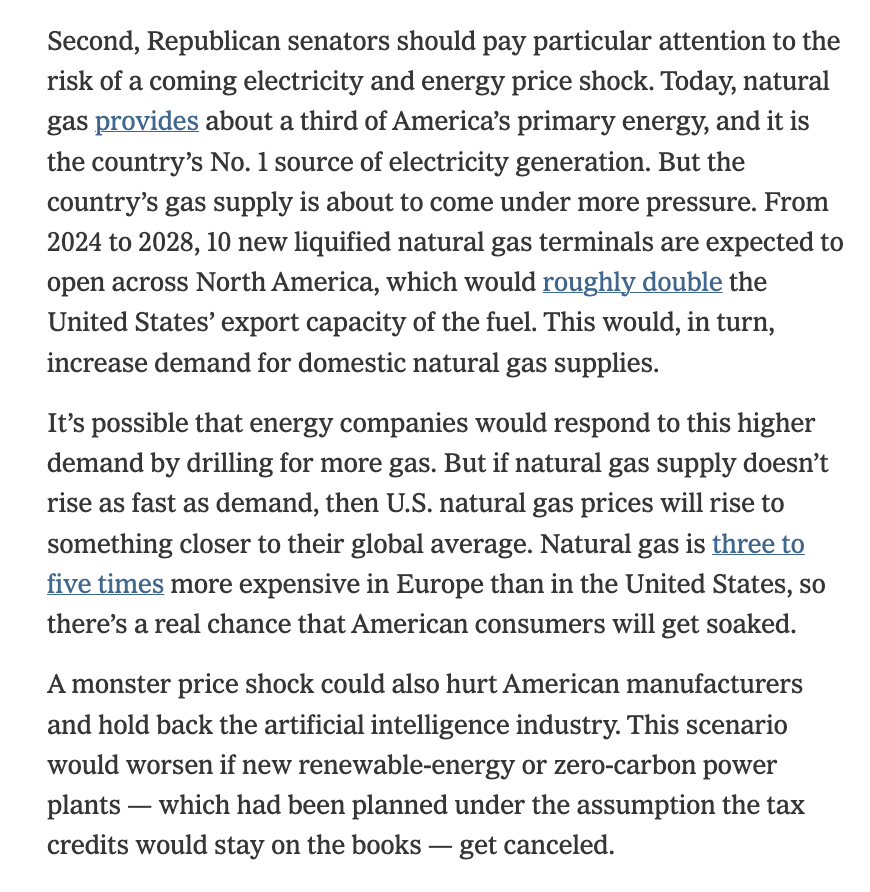

Great defense of how Inflation Reduction Act supports energy project deployment and tamps down electricity price volatility from Skanda Amarnath and Arnab Datta at Employ America today. These two arguments are particularly striking:

IS ANYONE PAYING ATTENTION TO NATURAL GAS PRICES? As LNG exports and AI data centers surge, the IRA serves as a hedge against electricity price shocks. Simply put: Gut the IRA, get ready to pay. New from Skanda Amarnath and me on Employ America. 🧵1/

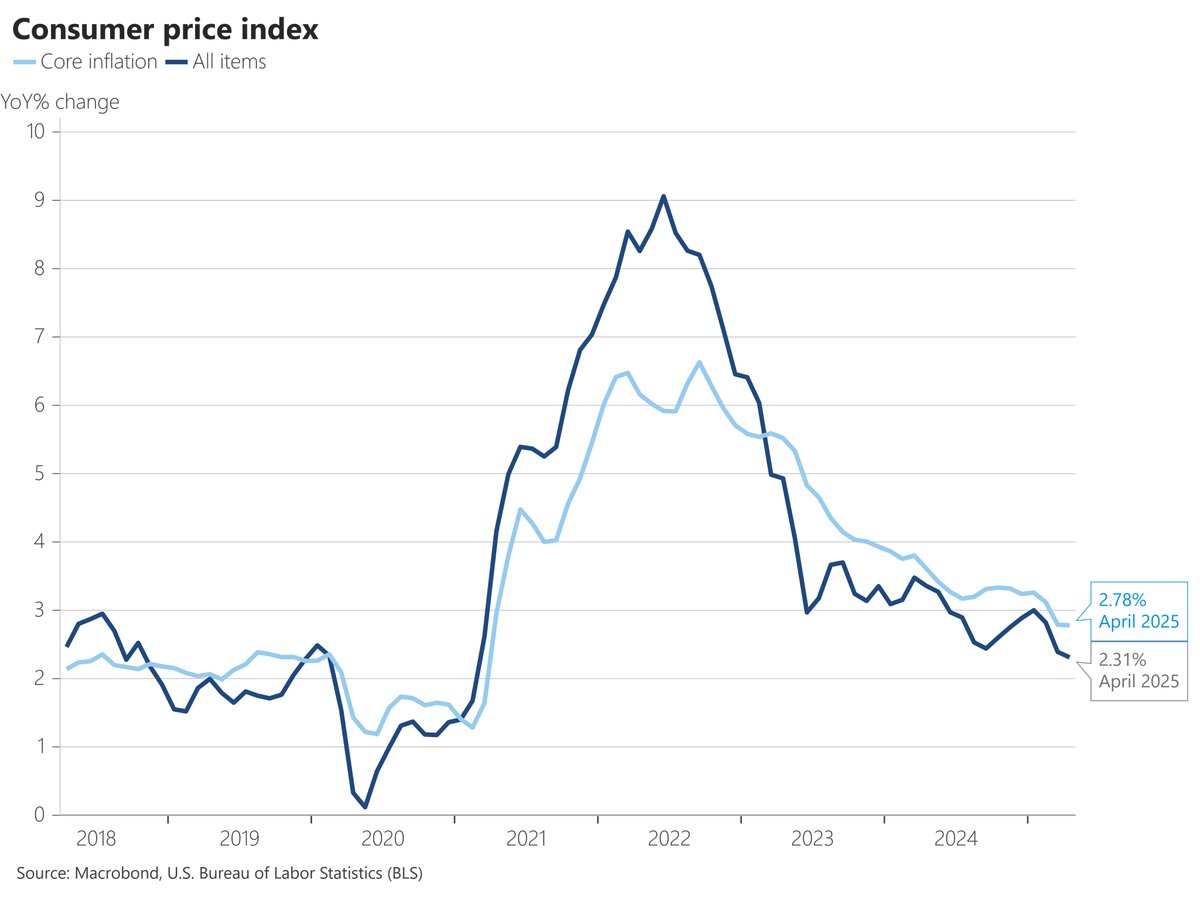

Amidst any tariff-related inflation, lower oil prices should help households. But gas prices haven’t eased recently 🤔 Plus, electricity prices are surging & expected to be more volatile (h/t Employ America) New blog 👇 Carson Investment Research Ryan Detrick, CMT carsongroup.com/insights/blog/…

Very few people have been more correct than Skanda Amarnath of Employ America. It was an honor to pick his 🧠 on how he sees the economy and macro backdrop playing out the rest of 2025. Our latest Facts vs Feelings is 🔥 Sonu Varghese youtu.be/YhL9VNJwSRk?si…

Incredibly important point from Robinson Meyer in the NYT today. Energy demand is swiftly growing. Pulling capacity growth offline will spike prices.

And more from Skanda Amarnath and me on this dynamic. employamerica.org/blog/supportin…